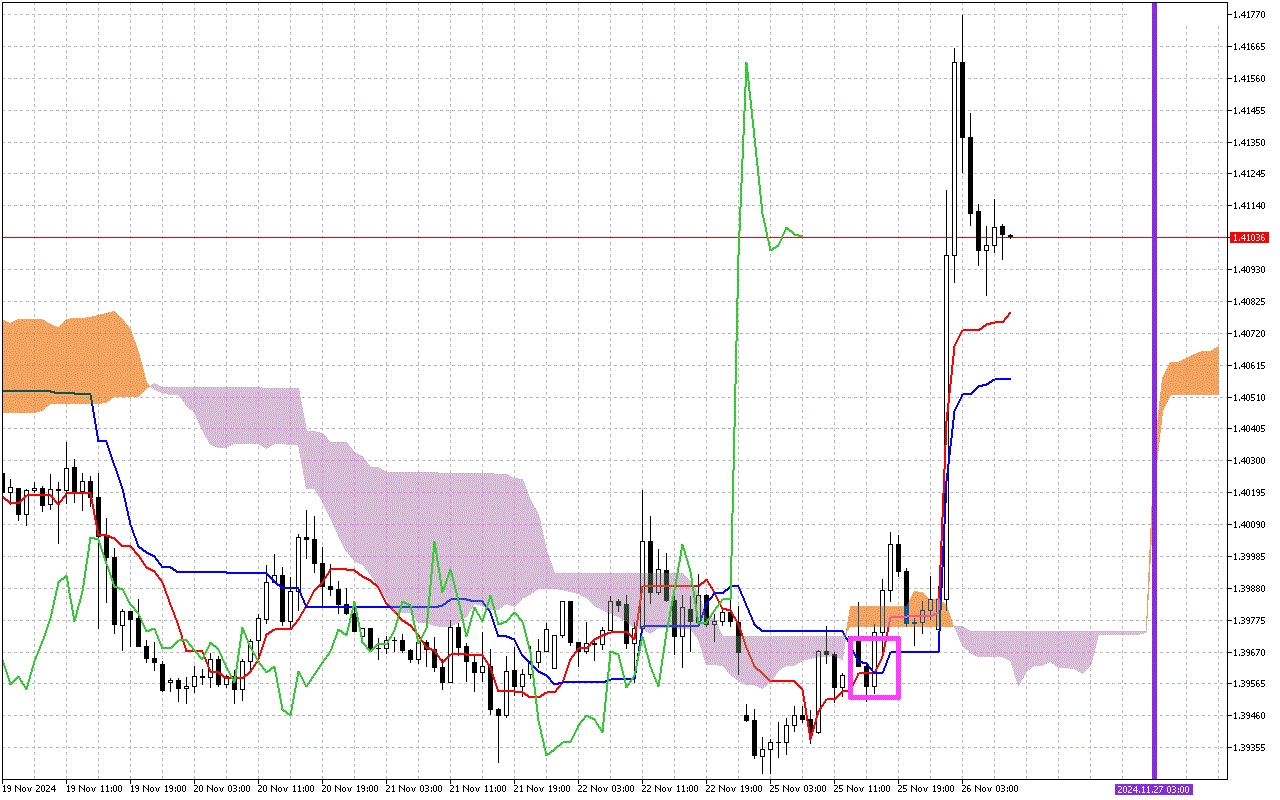

USDCAD H1: The Ichimoku Forecast for the European Session at 26.11.2024

The second most important signal is a change in the direction of movement of the cloud Kumo. This signal is marked on the chart with a vertical purple line. The orange color of the cloud indicates a change in the priority direction of movement to upward.

The current situation:

Let's look at the main components of the indicator and their current values:

The so-called Three Line Signal is being observed on the USDCAD chart now. The price is above the red Tenkan line, the blue Kijun line, and the Kumo cloud. This signal indicates the predominance of an upward movement.

The Kumo cloud is colored orange, indicating the market tendency to a continuing upward movement.

In addition, the price is above the Kumo cloud, which acts as a potential support zone.

The Chinkou line is now below the current price.

Trading recommendations:

Dynamic support levels are on the Tenkan line, around the 1.40755 mark, the Kijun line, around the 1.40567 mark, the SenkouA line, at the 1.39654mark, and the SenkouB line, around the 1.39737 mark.

The Ichimoku indicator signals show a predominance of the market positive sentiment, so within the day the preference should be given to the search for long positions entry points from the support levels indicated above.